Check borrowing capacity for home loan

Rate applies to loan amounts up to a maximum of 100000. For a term of 60-months based on new car rate of USEDREFINANCE.

How Do Car Loans Affect Your Financial Position The Broke Generation Car Loans Financial Position Budgeting Tips

Australian household usually discuss with finance advisors on home loan 3-4 years on average.

. The Canara Bank home loan EMI is calculated based on the loan amount loan tenure and rate of interest. Before committing to a particular home loan product check upfront with your lender and read the applicable loan documentation to confirm whether the terms of the loan meet your needs and repayment capacity. Save time apply online.

In 2017 to 2018 Hunter Galloway submitted 342 home loan applications and had 8 applications rejected giving a 233 rejection rate. You can check the EMI using Growws Canara Bank Home Loan calculator anytime. Prepare for Loan Documents.

PMAY Subsidy Calculator 91-9289200017. 50 Lacs when you move your outstanding home loan balance to HDFC. The lowest interest rate charged by Canara Bank on Home Loan is 690 which makes it one of the most popular housing loans in India.

Moreover the SZHP housing loan borrowers contribution of 15 per cent in the down payment for the housing loans that their profitinterest is guaranteed and paid by the federal government has. If youre a first home buyer check out this helpful guide to saving for a deposit. New vehicles are defined as the current or previous model year vehicle with less than 5000 miles.

It should only take around 20 minutes to. Estimate your borrowing power. This will help you get a better idea of what.

View your borrowing capacity and estimated home loan repayments. To understand more about borrowing capacity read more on this page. In March the finance ministry while fixing the Net Borrowing Ceiling NBC of the states for FY 2022-23 had said that borrowings by state public sector companiescorporations or their special purpose vehicles SPVs and other equivalent instruments where principal and interest are to be serviced out of the state budgets shall.

Fuss over states off-budget loans. Approximately 40 of home loan applications were rejected in December 2018 based on a survey of 52000 households completed by DigitalFinance Analytics DFA. Sign a Contract.

Pay down debts like personal loans. Make sure the moneylender issues to you a receipt every time you make any repayment towards your loan and check it for correctness eg. For instance you may use a personal loan to consolidate debt pay for home renovations or plan a dream wedding.

Speak to an expert. First Home Buyer. Cost of Buying.

Estimate how much you can borrow for your home loan using our borrowing power calculator. Loan rates and terms applicable to new vehicles only. Make sure you receive a statement of account for all your loans at least once every January and July and check it for correctness eg.

You can use a loan repayment calculator to try similar calculations based on your needs. Weve assumed a 250 interest rate and a 30-year loan term. Key Takeaways Home equity loans allow property owners to borrow against the debt-free value of their homes.

Here we take a closer look at landing a home equity loan if you have relatively bad credit. Reduce your credit limit on credit cards or close any unused credit cards. Increasing your income is a great way to boost your borrowing capacity.

Clearly higher interest rates are eroding borrowing capacity CoreLogics Tim Lawless told ABC News. Use Canstars home loan selector to view a wider range of home loan products. Our buying power calculator gives you an idea of the maximum you could spend on a property in minutes.

Minimum auto loan amount is 3750. They remain available from the Data Download Program. Special rates are available.

The expression own sources for this. Looking for more insight from a borrowing power calculator. Get lower interest rates and additional top-up loans of up to Rs.

Institution Product Variable floating 6 months 1 year 2 years 3 years 4 years 5 years. If youre using a Home Loan Experts broker to arrange your loan call us on 1300 889 743 or enquire online for assistance with your letter. To help you navigate how much you should ideally borrow and how well it will sit in your repayment capacity you can consider using a house loan EMI calculator relying on its accurate outputEnsure maximum home loan eligibility and secure favourable terms such as a low home loan interest rate and a comfortable home loan tenor by using the home loan.

This is to meet different financial goals and objectives down the path. Prices nationally would need to drop by 28 per cent to take the market back to where it was. Includes student loans originated by the Department of Education under the Federal Direct Loan Program and the Perkins Loan Program as well as Federal Family Education Program loans that the.

There are some things that may help increase your home loan borrowing capacity. Our buying power calculator helps you estimate your maximum property purchase price. The series of finance company new car loan terms included in previous releases are discontinued.

Before committing to a particular home loan product check upfront with your lender and read the applicable loan documentation to confirm whether extra repayments are permitted under the terms of the loan whether any additional fees or charges may apply and whether the terms of the loan meet your needs and repayment capacityComparison rate. Home Loan Balance Transfer Calculator. Full-function mortgage calculator LVR borrowing capacity Property upsizedownsize Principal payback milestone Break fee calculator Fix or float calculator Credit card real.

Other types of accountant letters There are many different reasons why a bank may request an accountants letter so there are many different templates that you may need to use. Consider whether you can take on extra shifts at work get a second job or consider your ability to get promoted in your current workplace and negotiate for a pay rise. A personal loan is an amount of money you can borrow to use for a variety of purposes.

Loan-to-value LTV ratio determines your maximum borrowing capacity which is usually 75 of the property price to finance your home based on the banks assessment on your total monthly income and other ongoing loans or financial liabilities you may have.

How Does Defi Lending Work Defi Lending And Borrowing

Don T Go Bust Borrowing Useful Credit Solutions Infographic No Credit Loans

Easy Loan In 2022 Easy Loans Finance Apps Loan

Net Worth Calculator Find Your Net Worth Nerdwallet Net Worth Consumer Debt Personal Loans

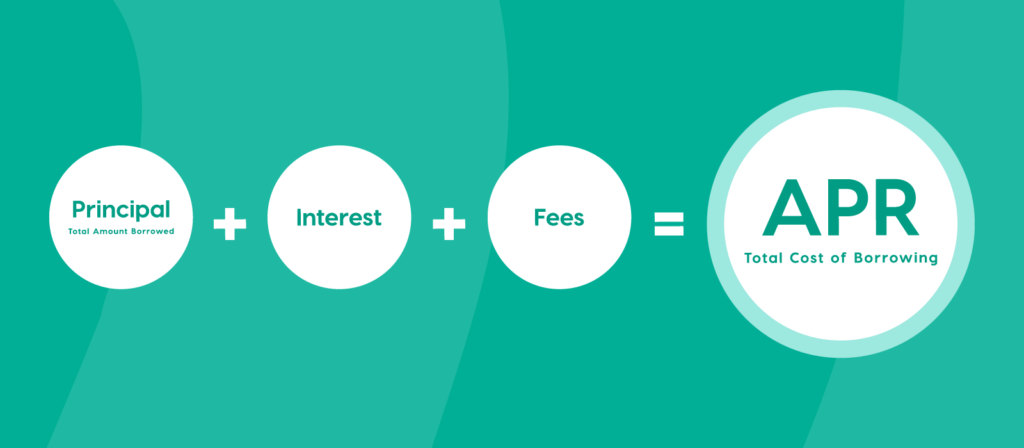

Learn The True Cost Of Borrowing Birchwood Credit

Simple Loan Application Form Template Fresh Equipment Borrowing Agreement Template Equipment Loan Application Form Loan Application Contract Template

Pin On Loans For Bad Credit Cash Advances

/how-to-get-a-loan-315510_V1-e8212e1a3dfe43358308f689cf51a284.png)

How To Get A Loan From A Bank

Heloc Calculator Calculate Available Home Equity Wowa Ca

/how-to-get-a-loan-315510_V1-e8212e1a3dfe43358308f689cf51a284.png)

How To Get A Loan From A Bank

This Moment Makes You Who You Are Clock Turning Point Truth This Moment Makes Y Spon Point Mortgage Loan Calculator Refinancing Mortgage Refinance Loans

How To Borrow Money For A Down Payment Loans Canada

Free Printable Loan Agreement Form Form Generic

A Collateral Mortgage Can Trap You Roseman Refinance Mortgage Refinancing Mortgage Mortgage Refinance Calculator

Family Loan Agreements Lending Money To Family Friends

Loancounsellor Com Provides You The Best Borrowing Options For Home Loan In Mumbai Contact Us Now For More Details Visit Www Lo Home Loans The Borrowers Loan

Answer True A Mortgage Is The Security That Lenders Hold In Support Of A Loan For The Purchase Of Real Estate The Borrower T Real Estate Tips True Mortgage